All Categories

Featured

Table of Contents

The lasting treatment motorcyclist is a kind of accelerated death advantage that can be utilized to pay for nursing-home, assisted-living, or in-home care when the insured needs help with activities of day-to-day living, such as showering, eating, and using the toilet. A guaranteed insurability rider lets the insurance holder acquire added insurance at a later day without a medical evaluation. This opportunity can come with high fees and a reduced death advantage, so it might only be a great alternative for individuals that have maxed out other tax-advantaged cost savings and investment accounts. The pension maximization approach explained earlier is one more way life insurance coverage can money retired life.

Insurance companies examine each life insurance policy candidate on a case-by-case basis. In 2023 there were more than 900 life insurance and wellness companies in the United States, according to the Insurance Details Institute.

You require life insurance if you need to supply safety for a partner, children, or various other relative in the event of your fatality. Life insurance policy survivor benefit can aid recipients pay off a home mortgage, cover university tuition, or aid fund retired life. Permanent life insurance policy likewise features a cash worth part that develops over time.

Life insurance policy survivor benefit are paid as a swelling amount and are exempt to government revenue tax since they are ruled out revenue for beneficiaries. Dependents don't have to stress over living expenditures - Life insurance. Most plan calculators recommend a several of your gross earnings equal to 7 to 10 years that can cover significant expenses such as home loans and college tuition without the surviving spouse or kids having to obtain lendings

How do I cancel Accidental Death?

When you choose what sort of insurance coverage you require and just how much insurance coverage makes good sense for your scenario, compare items from top life insurance companies to identify the very best fit.

Energetic worker has to be permanent (routine standing, 80% or greater) or part-time (normal status, 40%-79%) - Term life insurance. If you elect dependent and/or spouse/qualifying grown-up coverage, you will be needed to finish a Statement of Health and wellness. The Supplemental Life portion of the strategy provides additional protection for those that rely on you economically

Benefit choices are readily available in numerous increments with the minimal benefit amount as $20,000 and the maximum advantage amount as $500,000. If you are presently registered in Supplemental Life, you might raise your insurance coverage by one level without a Declaration of Health. Any kind of added level of coverage will call for a Statement of Health.

No individual might be guaranteed as a Dependent of more than one worker. For your youngster to be eligible for coverage, your kid must: Be 14 days to 1 years of age for $500 or 1 years of age approximately 26 years for $10,000 (over 26 years may be continued if the Reliant Kid fulfills the Handicapped Child demands) No individual can be insured as a reliant of even more than one staff member If you end up being terminally ill as a result of an injury or sickness, you or your legal representative have the choice to ask for an ABO.

What is the most popular Retirement Planning plan in 2024?

The taxable cost of this group term life insurance policy is computed on the basis of consistent costs prices determined by the Irs based on the staff member's age. MetLife chose AXA Support U.S.A., Inc. to be the manager for Traveling Assistance solutions. This service helps intervene in medical emergencies in international countries.

You will certainly owe taxes if any part of the quantity you withdraw is from rate of interest, rewards or capital gains. Also be aware that the quantity you take out will certainly be deducted from the plan's death advantage if it's not repaid. You'll be billed interest if you get a lending against your irreversible life plan, but it's typically less than the rate of interest charged by other lenders.

What is the best Retirement Security option?

It's a valuable living benefit to have when you take into consideration that 70 percent of people transforming 65 today will require some form of lasting care in their lives.

Right here's just how: is a type of permanent life insurance policy (as is global and variable life). Irreversible life insurance policy plans will enable you to access of your account while you live. Term life insurance policy, at the same time, does not have a cash component for insurance holders to gain access to. If you're planning on using your life insurance policy as a back-up money resource you'll desire to stay clear of term policies.

And you will not have instant accessibility to cash money once the plan goes online. You'll require an adequate cash money quantity in the account prior to you can utilize it (and it requires time to develop that up).Get a complimentary cost quote now. Thinking you have a policy that has a money component to it, you could after that surrender it and withdraw the whole present cash money worth.

It's a popular that you can't use your life insurance while alive. Not just can you potentially use it, yet it may also be a much better lorry than various other forms of credit.

How do I apply for Final Expense?

If you want the benefits this alternative can manage then start by obtaining a totally free estimate. Matt Richardson is the managing editor for the Handling Your Cash area for He composes and edits content about individual money varying from savings to spending to insurance.

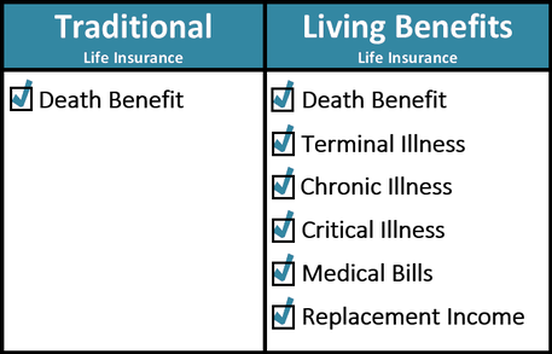

Life Insurance coverage with living advantage riders offers monetary security during significant life occasions or wellness problems. These riders can be included to long-term and term life insurance policy policies, but the terms differ.

At its core, life insurance coverage is created to give monetary protection to your enjoyed ones in the event of your fatality. As the requirements and needs of consumers have evolved, so have life insurance items.

Table of Contents

Latest Posts

Good Funeral Cover

Instant Universal Life Insurance Quote

One Life Final Expense

More

Latest Posts

Good Funeral Cover

Instant Universal Life Insurance Quote

One Life Final Expense