All Categories

Featured

Table of Contents

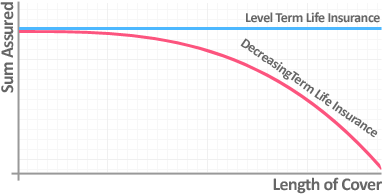

A level term life insurance policy policy can give you satisfaction that the individuals that depend upon you will have a death advantage throughout the years that you are planning to sustain them. It's a way to aid look after them in the future, today. A level term life insurance coverage (occasionally called level costs term life insurance coverage) policy provides coverage for an established variety of years (e.g., 10 or two decades) while keeping the premium settlements the very same throughout of the plan.

With degree term insurance coverage, the cost of the insurance coverage will remain the very same (or possibly reduce if returns are paid) over the term of your plan, typically 10 or 20 years. Unlike irreversible life insurance policy, which never ever ends as long as you pay premiums, a level term life insurance policy will finish eventually in the future, commonly at the end of the period of your degree term.

What is a What Is Level Term Life Insurance Policy?

Due to this, many individuals utilize long-term insurance policy as a secure monetary planning tool that can offer many needs. You may have the ability to convert some, or all, of your term insurance coverage throughout a set duration, usually the initial one decade of your policy, without requiring to re-qualify for protection also if your health and wellness has altered.

As it does, you may want to include to your insurance coverage in the future - Term life insurance with level premiums. As this takes place, you might desire to eventually decrease your death benefit or consider transforming your term insurance coverage to a long-term plan.

So long as you pay your costs, you can rest very easy understanding that your enjoyed ones will certainly obtain a fatality advantage if you die throughout the term. Numerous term plans permit you the capacity to convert to irreversible insurance policy without needing to take one more wellness examination. This can allow you to capitalize on the additional advantages of an irreversible policy.

Level term life insurance policy is just one of the easiest courses right into life insurance coverage, we'll review the advantages and disadvantages so that you can choose a strategy to fit your needs. Level term life insurance policy is one of the most typical and fundamental form of term life. When you're searching for momentary life insurance coverage plans, level term life insurance policy is one route that you can go.

You'll load out an application that has basic individual info such as your name, age, etc as well as a more comprehensive survey regarding your clinical history.

The short answer is no. A degree term life insurance policy policy does not construct cash value. If you're wanting to have a policy that you have the ability to withdraw or borrow from, you might discover permanent life insurance policy. Entire life insurance plans, as an example, let you have the convenience of survivor benefit and can build up money value over time, indicating you'll have more control over your benefits while you're to life.

What is Term Life Insurance For Seniors? Pros, Cons, and Features

Cyclists are optional arrangements added to your plan that can provide you added advantages and defenses. Anything can occur over the program of your life insurance policy term, and you want to be ready for anything.

This biker gives term life insurance policy on your children with the ages of 18-25. There are circumstances where these advantages are built right into your policy, but they can additionally be available as a separate addition that needs additional payment. This rider supplies an extra death benefit to your beneficiary should you pass away as the outcome of an accident.

Table of Contents

Latest Posts

Good Funeral Cover

Instant Universal Life Insurance Quote

One Life Final Expense

More

Latest Posts

Good Funeral Cover

Instant Universal Life Insurance Quote

One Life Final Expense