All Categories

Featured

Table of Contents

Nevertheless, maintaining all of these phrases and insurance coverage kinds right can be a frustration - mortgage protection insurance anz. The following table positions them side-by-side so you can promptly set apart amongst them if you obtain puzzled. One more insurance coverage type that can pay off your home loan if you die is a common life insurance coverage plan

A remains in location for a set variety of years, such as 10, 20 or three decades, and pays your recipients if you were to die during that term. A gives insurance coverage for your entire lifetime and pays when you die. As opposed to paying your home mortgage lender straight the method mortgage security insurance does, basic life insurance policies most likely to the recipients you choose, who can then pick to pay off the mortgage.

One typical general rule is to intend for a life insurance policy plan that will pay out as much as 10 times the insurance policy holder's wage quantity. Additionally, you may choose to make use of something like the DIME approach, which adds a family's financial debt, earnings, mortgage and education and learning costs to compute just how much life insurance is needed (mortgage repayments insurance).

It's additionally worth noting that there are age-related limitations and thresholds imposed by nearly all insurers, that often will not offer older purchasers as several alternatives, will bill them much more or might refute them outright.

Below's exactly how home loan protection insurance coverage determines up against conventional life insurance policy. If you're able to qualify for term life insurance coverage, you must stay clear of mortgage defense insurance (MPI).

In those scenarios, MPI can offer wonderful peace of mind. Just be sure to comparison-shop and read all of the small print before enrolling in any type of policy. Every home loan security alternative will certainly have countless policies, guidelines, advantage choices and drawbacks that require to be considered very carefully versus your accurate situation (best mortgage insurance in case of death).

Mortgage Term Life Insurance Rates

A life insurance policy plan can aid pay off your home's mortgage if you were to die. It is just one of lots of manner ins which life insurance policy might help shield your liked ones and their monetary future. Among the very best ways to factor your mortgage right into your life insurance policy demand is to chat with your insurance coverage agent.

Rather than a one-size-fits-all life insurance policy policy, American Family Life Insurance provider provides plans that can be made specifically to meet your family's demands. Here are some of your options: A term life insurance policy policy. life insurance mortgage uk is energetic for a details quantity of time and typically supplies a bigger quantity of insurance coverage at a reduced rate than a long-term policy

Rather than only covering an established number of years, it can cover you for your whole life. It additionally has living benefits, such as cash value buildup. * American Household Life Insurance Company supplies various life insurance policy policies.

They may likewise be able to aid you discover spaces in your life insurance policy protection or new ways to save on your various other insurance coverage plans. A life insurance coverage beneficiary can choose to make use of the death benefit for anything.

Life insurance is one method of assisting your household in paying off a mortgage if you were to pass away prior to the mortgage is completely repaid. Life insurance coverage profits may be utilized to help pay off a mortgage, however it is not the very same as home loan insurance policy that you may be called for to have as a condition of a funding.

Life And Critical Illness Mortgage Cover

Life insurance policy might aid guarantee your house stays in your family members by supplying a fatality benefit that might help pay down a home loan or make important purchases if you were to pass away. This is a brief summary of protection and is subject to plan and/or rider terms and conditions, which may vary by state.

The words life time, lifelong and irreversible are subject to policy conditions. * Any finances taken from your life insurance policy policy will certainly accrue passion. compare payment protection insurance. Any kind of outstanding financing equilibrium (funding plus rate of interest) will be deducted from the fatality advantage at the time of insurance claim or from the cash money value at the time of surrender

** Based on policy conditions. ***Discounts may differ by state and business underwriting the auto or house owners policy. Discount rates might not use to all insurance coverages on a vehicle or homeowners policy. Price cuts do not put on the life policy. Plan Kinds: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

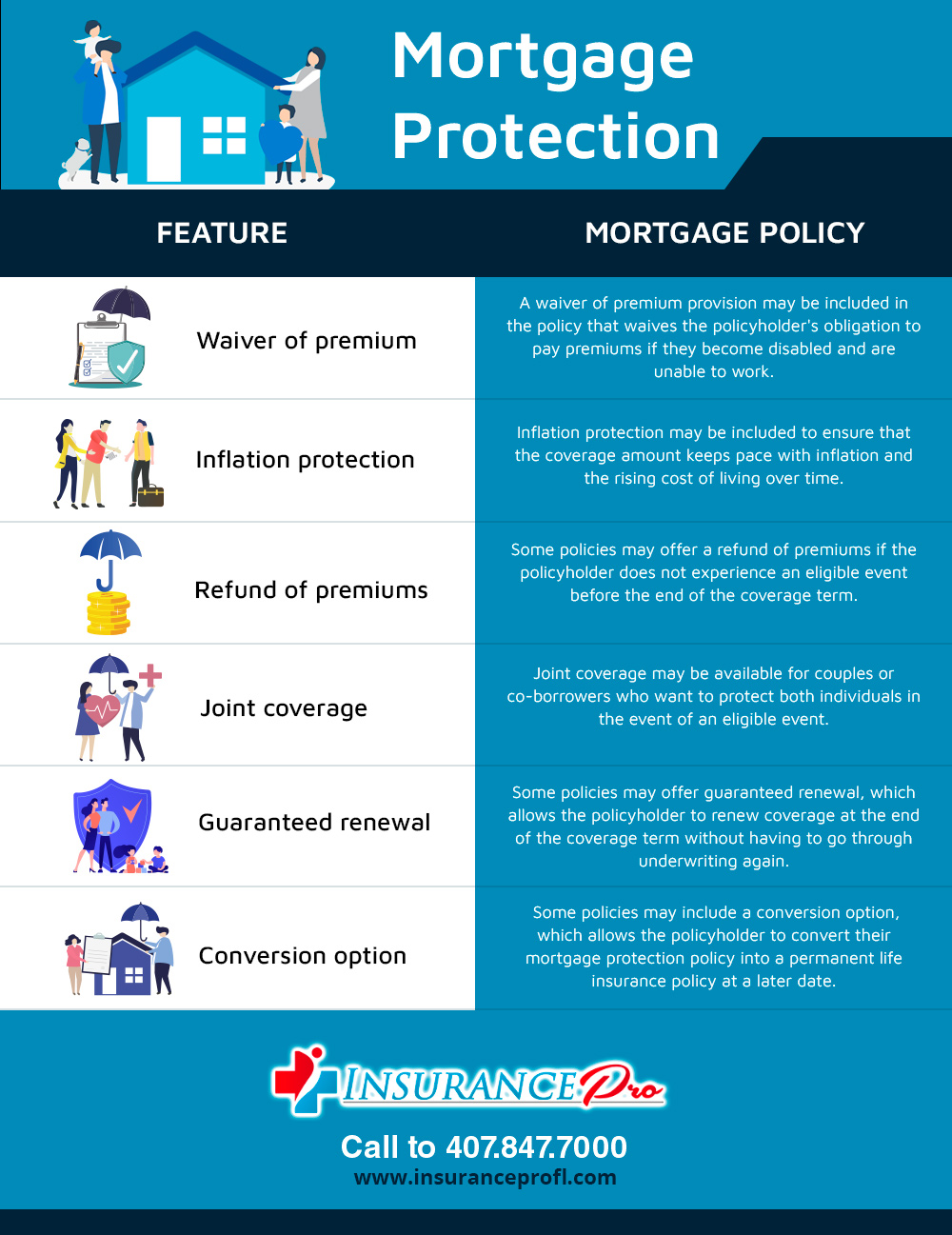

Home loan defense insurance (MPI) is a various kind of secure that might be practical if you're unable to settle your home mortgage. While that additional defense seems excellent, MPI isn't for everybody. Right here's when home loan defense insurance policy is worth it. Home loan defense insurance is an insurance coverage that settles the rest of your home loan if you die or if you become impaired and can't work.

Both PMI and MIP are needed insurance protections. The quantity you'll pay for home mortgage defense insurance policy depends on a variety of elements, consisting of the insurance firm and the present balance of your mortgage.

Still, there are pros and disadvantages: A lot of MPI policies are provided on a "guaranteed acceptance" basis. That can be advantageous if you have a health and wellness problem and pay high rates forever insurance or battle to get coverage. compare payment protection insurance. An MPI policy can give you and your family members with a feeling of safety and security

Companies That Offer Mortgage Protection Insurance

You can select whether you require mortgage protection insurance coverage and for how lengthy you need it. You could want your home loan security insurance term to be close in length to how long you have left to pay off your home mortgage You can terminate a home mortgage security insurance plan.

Table of Contents

Latest Posts

Good Funeral Cover

Instant Universal Life Insurance Quote

One Life Final Expense

More

Latest Posts

Good Funeral Cover

Instant Universal Life Insurance Quote

One Life Final Expense