All Categories

Featured

Table of Contents

Insurer will not pay a small. Instead, think about leaving the cash to an estate or depend on. For even more in-depth info on life insurance coverage obtain a duplicate of the NAIC Life Insurance Policy Purchasers Overview.

The internal revenue service places a limitation on just how much cash can enter into life insurance coverage costs for the plan and exactly how swiftly such costs can be paid in order for the plan to retain every one of its tax benefits. If specific limitations are exceeded, a MEC results. MEC insurance holders might be subject to tax obligations on distributions on an income-first basis, that is, to the extent there is gain in their policies, along with fines on any type of taxed quantity if they are not age 59 1/2 or older.

Please note that superior financings accrue interest. Earnings tax-free therapy also thinks the car loan will become pleased from earnings tax-free survivor benefit earnings. Fundings and withdrawals lower the plan's cash money worth and death benefit, may trigger particular plan advantages or bikers to become unavailable and might enhance the opportunity the plan might lapse.

A customer may qualify for the life insurance policy, however not the rider. A variable global life insurance policy contract is an agreement with the main function of providing a fatality advantage.

What is the best Life Insurance option?

These profiles are carefully handled in order to satisfy stated financial investment objectives. There are costs and charges related to variable life insurance policy agreements, including mortality and risk charges, a front-end tons, administrative costs, investment administration fees, abandonment fees and fees for optional riders. Equitable Financial and its associates do not supply lawful or tax obligation advice.

Whether you're beginning a family or getting wedded, individuals usually begin to think of life insurance policy when another person begins to depend upon their capacity to earn an earnings. Which's wonderful, since that's precisely what the death benefit is for. But, as you discover more about life insurance policy, you're most likely to discover that lots of plans as an example, entire life insurance policy have a lot more than just a survivor benefit.

What are the benefits of whole life insurance policy? Below are several of the key things you must know. One of one of the most appealing advantages of buying a whole life insurance policy plan is this: As long as you pay your premiums, your survivor benefit will never ever expire. It is assured to be paid no matter of when you pass away, whether that's tomorrow, in 5 years, 80 years or perhaps additionally away. Protection plans.

Think you don't need life insurance if you do not have children? You may intend to think again. It may feel like an unnecessary expenditure. There are several benefits to having life insurance, even if you're not sustaining a family members. Below are 5 reasons why you must acquire life insurance policy.

Who offers Estate Planning?

Funeral expenditures, interment expenses and clinical bills can accumulate (Retirement planning). The last thing you want is for your liked ones to carry this added concern. Long-term life insurance policy is available in various quantities, so you can select a survivor benefit that satisfies your needs. Alright, this just uses if you have youngsters.

Determine whether term or irreversible life insurance policy is best for you. Get a price quote of how much coverage you might need, and how much it might set you back. Discover the right quantity for your spending plan and satisfaction. Find your quantity. As your personal circumstances modification (i.e., marriage, birth of a youngster or task promotion), so will certainly your life insurance policy needs.

For the most part, there are two kinds of life insurance prepares - either term or long-term strategies or some combination of the two. Life insurance firms provide various kinds of term strategies and conventional life plans along with "interest delicate" items which have ended up being a lot more common since the 1980's.

Term insurance policy provides protection for a given amount of time. This period can be as brief as one year or give coverage for a specific variety of years such as 5, 10, two decades or to a defined age such as 80 or in some instances approximately the oldest age in the life insurance policy mortality tables.

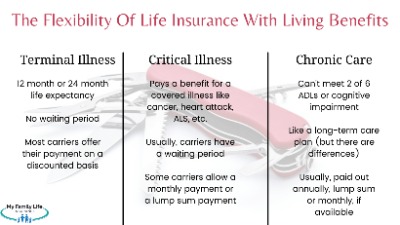

How can Living Benefits protect my family?

Currently term insurance coverage rates are extremely affordable and amongst the most affordable historically knowledgeable. It must be kept in mind that it is an extensively held idea that term insurance policy is the least costly pure life insurance policy coverage offered. One requires to assess the plan terms thoroughly to make a decision which term life alternatives are suitable to fulfill your particular situations.

With each new term the costs is enhanced. The right to restore the plan without evidence of insurability is an important benefit to you. Or else, the danger you take is that your health and wellness may weaken and you might be not able to get a plan at the very same prices or perhaps at all, leaving you and your beneficiaries without protection.

The size of the conversion duration will differ depending on the type of term policy bought. The premium price you pay on conversion is usually based on your "present achieved age", which is your age on the conversion date.

Under a level term policy the face amount of the plan continues to be the very same for the whole duration. With decreasing term the face quantity minimizes over the duration. The costs remains the very same yearly. Typically such policies are marketed as mortgage protection with the quantity of insurance coverage decreasing as the equilibrium of the mortgage reduces.

Is there a budget-friendly Guaranteed Benefits option?

Commonly, insurance providers have actually not can alter premiums after the plan is marketed. Because such plans may continue for years, insurance companies have to utilize traditional death, interest and cost rate price quotes in the costs calculation. Adjustable premium insurance, nevertheless, enables insurance providers to provide insurance policy at lower "present" costs based upon much less conservative presumptions with the right to alter these premiums in the future.

While term insurance policy is designed to offer protection for a specified time duration, irreversible insurance is made to give protection for your whole life time. To maintain the premium rate degree, the costs at the younger ages goes beyond the actual expense of security. This additional costs constructs a get (cash worth) which helps pay for the plan in later years as the cost of defense rises above the costs.

Under some plans, costs are required to be paid for an established variety of years. Under various other policies, premiums are paid throughout the insurance holder's life time. The insurer spends the excess premium bucks This sort of policy, which is sometimes called cash value life insurance coverage, produces a cost savings component. Cash worths are essential to an irreversible life insurance coverage policy.

Table of Contents

Latest Posts

Good Funeral Cover

Instant Universal Life Insurance Quote

One Life Final Expense

More

Latest Posts

Good Funeral Cover

Instant Universal Life Insurance Quote

One Life Final Expense