All Categories

Featured

Table of Contents

If George is diagnosed with a terminal disease during the initial plan term, he probably will not be eligible to restore the plan when it ends. Some plans use assured re-insurability (without evidence of insurability), yet such functions come at a greater price. There are numerous kinds of term life insurance policy.

Normally, most business supply terms ranging from 10 to thirty years, although a couple of offer 35- and 40-year terms. Level-premium insurance coverage has a fixed regular monthly payment for the life of the policy. The majority of term life insurance has a degree costs, and it's the kind we've been describing in many of this article.

Term life insurance policy is eye-catching to young people with youngsters. Moms and dads can get considerable coverage for a reduced expense, and if the insured dies while the policy is in effect, the family can rely upon the survivor benefit to replace lost income. These plans are likewise appropriate for individuals with expanding families.

The Meaning of Term Life Insurance Level Term

The ideal choice for you will depend on your requirements. Here are some things to think about. Term life plans are excellent for people that want substantial insurance coverage at an affordable. Individuals who own whole life insurance coverage pay extra in premiums for much less protection but have the security of understanding they are protected permanently.

The conversion biker ought to permit you to transform to any kind of long-term policy the insurer supplies without constraints. The key features of the biker are maintaining the original health and wellness score of the term policy upon conversion (even if you later on have wellness problems or end up being uninsurable) and making a decision when and just how much of the insurance coverage to convert.

Of training course, general costs will boost considerably since whole life insurance policy is much more expensive than term life insurance policy. Medical conditions that create during the term life period can not cause premiums to be boosted.

What is Voluntary Term Life Insurance? Your Guide to the Basics?

Entire life insurance comes with substantially greater month-to-month premiums. It is suggested to give insurance coverage for as long as you live.

It depends on their age. Insurance provider set a maximum age limitation for term life insurance coverage plans. This is usually 80 to 90 years of ages however may be higher or reduced depending upon the company. The costs additionally increases with age, so a person matured 60 or 70 will certainly pay considerably even more than somebody years younger.

Term life is rather similar to vehicle insurance coverage. It's statistically unlikely that you'll need it, and the costs are money away if you do not. But if the worst takes place, your family will get the advantages (Annual renewable term life insurance).

What is Term Life Insurance For Seniors? A Guide for Families?

Generally, there are two types of life insurance policy plans - either term or irreversible plans or some mix of the 2. Life insurance providers supply different kinds of term plans and typical life plans along with "rate of interest sensitive" products which have actually become a lot more common considering that the 1980's.

Term insurance policy provides protection for a given duration of time. This period could be as short as one year or give insurance coverage for a specific number of years such as 5, 10, two decades or to a specified age such as 80 or sometimes up to the oldest age in the life insurance coverage mortality tables.

Why You Need to Understand 20-year Level Term Life Insurance

Currently term insurance prices are very affordable and amongst the most affordable historically experienced. It must be noted that it is an extensively held idea that term insurance coverage is the least expensive pure life insurance policy protection readily available. One requires to examine the policy terms carefully to determine which term life choices appropriate to fulfill your specific circumstances.

With each brand-new term the premium is enhanced. The right to restore the plan without evidence of insurability is an important advantage to you. Otherwise, the risk you take is that your health might weaken and you might be not able to acquire a policy at the same rates and even in all, leaving you and your beneficiaries without protection.

You need to exercise this option throughout the conversion period. The length of the conversion period will certainly differ relying on the sort of term policy acquired. If you transform within the recommended duration, you are not required to give any details about your health. The costs price you pay on conversion is generally based upon your "present attained age", which is your age on the conversion date.

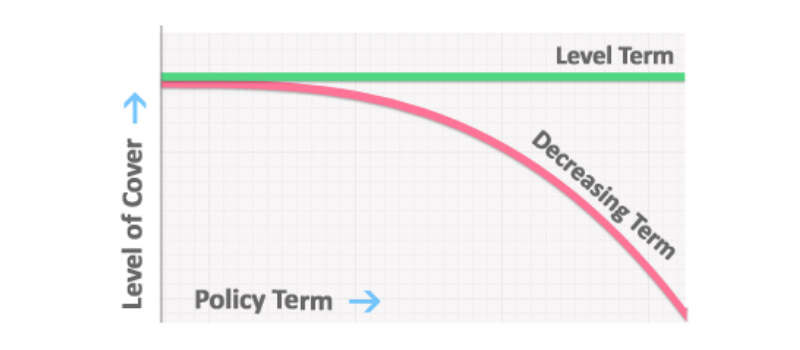

Under a level term policy the face quantity of the policy remains the exact same for the entire period. Often such plans are sold as home loan protection with the quantity of insurance decreasing as the balance of the mortgage lowers.

Traditionally, insurers have not deserved to alter costs after the plan is marketed. Given that such policies may proceed for years, insurance firms need to utilize conventional mortality, interest and expenditure rate estimates in the premium estimation. Flexible premium insurance, however, allows insurance firms to provide insurance coverage at reduced "present" premiums based upon less conventional assumptions with the right to alter these premiums in the future.

What is Level Benefit Term Life Insurance? A Simple Breakdown

While term insurance policy is designed to give protection for a specified period, irreversible insurance coverage is designed to supply coverage for your entire life time. To keep the costs rate degree, the premium at the younger ages exceeds the actual price of protection. This additional premium develops a reserve (money value) which helps pay for the plan in later years as the cost of protection rises above the costs.

Under some plans, premiums are required to be paid for a set variety of years (Term Life Insurance). Under various other policies, premiums are paid throughout the policyholder's lifetime. The insurer invests the excess premium dollars This kind of plan, which is sometimes called money value life insurance policy, creates a cost savings element. Money values are essential to an irreversible life insurance policy.

In some cases, there is no relationship between the dimension of the cash money value and the costs paid. It is the money value of the policy that can be accessed while the insurance holder lives. The Commissioners 1980 Criterion Ordinary Mortality (CSO) is the existing table used in computing minimal nonforfeiture worths and plan books for ordinary life insurance policy plans.

What is Life Insurance? Important Insights?

Many long-term policies will certainly contain arrangements, which specify these tax obligation demands. Typical whole life policies are based upon long-term quotes of expenditure, rate of interest and mortality.

Table of Contents

Latest Posts

Good Funeral Cover

Instant Universal Life Insurance Quote

One Life Final Expense

More

Latest Posts

Good Funeral Cover

Instant Universal Life Insurance Quote

One Life Final Expense